The Basic Principles Of Amur Capital Management Corporation

The Basic Principles Of Amur Capital Management Corporation

Blog Article

Amur Capital Management Corporation Fundamentals Explained

Table of ContentsLittle Known Questions About Amur Capital Management Corporation.How Amur Capital Management Corporation can Save You Time, Stress, and Money.The Main Principles Of Amur Capital Management Corporation Amur Capital Management Corporation for BeginnersThe Greatest Guide To Amur Capital Management CorporationSome Known Incorrect Statements About Amur Capital Management Corporation Some Known Facts About Amur Capital Management Corporation.

A low P/E ratio may indicate that a firm is underestimated, or that investors expect the company to deal with extra difficult times in advance. Financiers can utilize the average P/E proportion of other companies in the very same sector to develop a standard.

3 Simple Techniques For Amur Capital Management Corporation

The standard in the vehicle and truck sector is simply 15. A stock's P/E proportion is easy to find on many financial coverage internet sites. This number suggests the volatility of a supply in contrast to the marketplace in its entirety. A safety and security with a beta of 1 will display volatility that's similar to that of the market.

A stock with a beta of over 1 is theoretically much more unstable than the marketplace. A protection with a beta of 1.3 is 30% even more unstable than the market. If the S&P 500 rises 5%, a supply with a beta of 1. https://sandbox.zenodo.org/records/56679.3 can be anticipated to increase by 8%

How Amur Capital Management Corporation can Save You Time, Stress, and Money.

EPS is a buck figure representing the section of a business's earnings, after taxes and participating preferred stock dividends, that is assigned to every share of typical stock. Capitalists can utilize this number to assess just how well a business can provide worth to investors. A higher EPS results in higher share rates.

If a company frequently stops working to supply on profits projections, a capitalist might wish to reassess purchasing the supply - capital management. The computation is simple. If a business has a net revenue of $40 million and pays $4 million in dividends, after that the remaining sum of $36 million is divided by the number of shares superior

Amur Capital Management Corporation Fundamentals Explained

Capitalists commonly obtain thinking about a stock after reviewing headlines concerning its phenomenal performance. Just remember, that's the other day's information. Or, as the spending pamphlets always expression it, "Past efficiency is not a forecaster of future returns." Audio investing choices should think about context. A check out the trend in costs over the previous 52 weeks at the least is needed to get a sense of where a stock's cost might go following.

Let's look at what these terms imply, exactly how they vary and which one is finest for the ordinary capitalist. Technical analysts comb via massive volumes of data in an initiative to forecast the instructions of supply rates. The data consists largely of previous pricing info and trading quantity. Basic analysis fits the needs of a lot of investors and has the advantage of making great feeling in the genuine world.

They think rates adhere to a pattern, and if they can decipher the pattern they can utilize on it with well-timed professions. In recent decades, technology has actually enabled even more investors to exercise this style of investing due to the fact that the tools and the information are more easily accessible than ever before. Basic analysts think about the inherent value of a stock.

The Only Guide to Amur Capital Management Corporation

Technical analysis is ideal suited to somebody that has the time and convenience level with information to put infinite numbers to utilize. Over a period of 20 years, yearly charges of 0.50% on a $100,000 investment will certainly minimize the profile's worth by $10,000. Over the same period, a 1% cost will reduce the very same portfolio by $30,000.

The pattern is with you. Numerous mutual fund companies and on-line brokers are decreasing their charges in order to compete for clients. Benefit from the fad and search for the most affordable price.

Amur Capital Management Corporation Fundamentals Explained

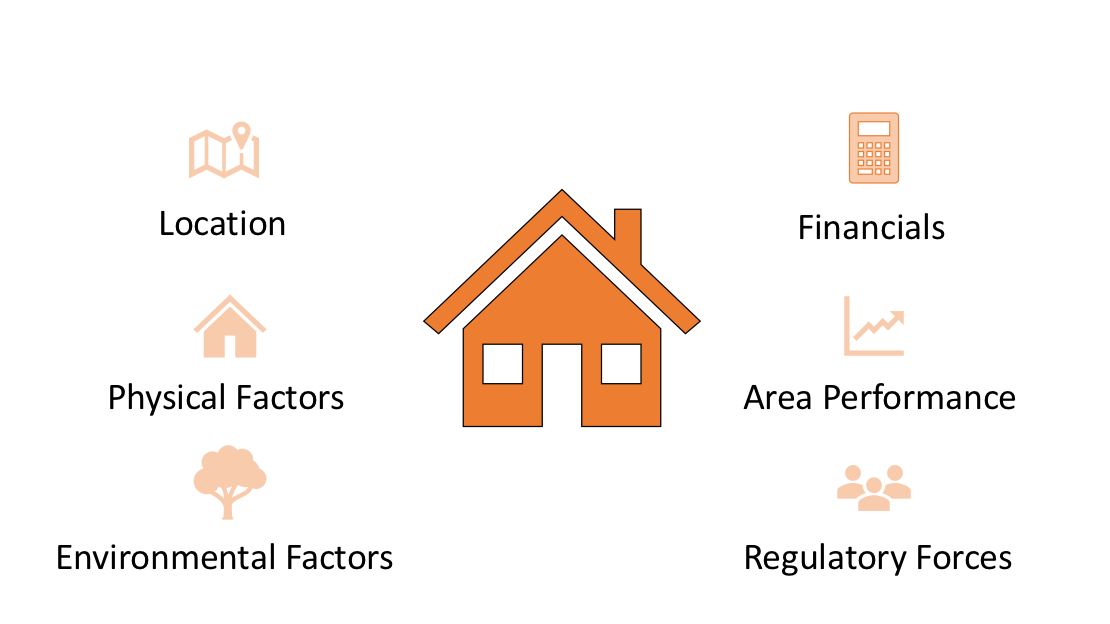

Closeness to facilities, environment-friendly space, scenic sights, and the community's status factor prominently right into home valuations. Nearness to markets, stockrooms, transportation centers, highways, and tax-exempt locations play a crucial role in industrial residential property valuations. A key when taking into consideration residential property place is the mid-to-long-term sight regarding exactly how the area is anticipated to evolve over the financial investment period.

Some Known Factual Statements About Amur Capital Management Corporation

Completely examine the ownership and intended usage of the instant locations where you prepare to spend. One means to accumulate details about the potential customers of the location of the residential property you are considering is to call the community hall or various other public companies in fee of zoning and city planning.

Building assessment is necessary for funding throughout the acquisition, market price, investment evaluation, insurance, and taxationthey all depend on genuine estate evaluation. Generally utilized realty appraisal techniques consist of: Sales contrast technique: recent similar sales of properties with comparable characteristicsmost usual and ideal for both new and old buildings Expense method: the cost of the land and building, minus depreciation suitable for new construction Revenue approach: based upon anticipated cash inflowssuitable for rentals Given the reduced liquidity and high-value financial investment in realty, a lack of clearness deliberately might go to this website bring about unexpected results, consisting of economic distressparticularly if the investment is mortgaged. This uses normal earnings and lasting worth admiration. This is typically for quick, tiny to medium profitthe normal property is under building and sold at an earnings on conclusion.

Report this page